Condo Insurance in and around Salem

Townhome owners of Salem, State Farm has you covered.

Quality coverage for your condo and belongings inside

- Windham

- Derry

- Hampstead

- Londonderry

- Hudson

- Atkinson

- Plaistow

- Auburn

- Pelham

- Salem

- Rockingham County

- Hillsborough County

- Chester

Condo Sweet Condo Starts With State Farm

With the variety of condo insurance options to choose from, you may be feeling overwhelmed. That's why we made choosing State Farm uncomplicated. As one of the leading providers of condo unitowners insurance, you can enjoy incredible service and coverage that is competitively priced. And this is not only for your unit but also for your personal belongings inside, including things like books, home gadgets and tools.

Townhome owners of Salem, State Farm has you covered.

Quality coverage for your condo and belongings inside

Safeguard Your Greatest Asset

Condo unitowners coverage like this is what sets State Farm apart from the rest. Agent Ed Ibanez can be there whenever the unexpected happens to help you submit your claim. State Farm is there for you.

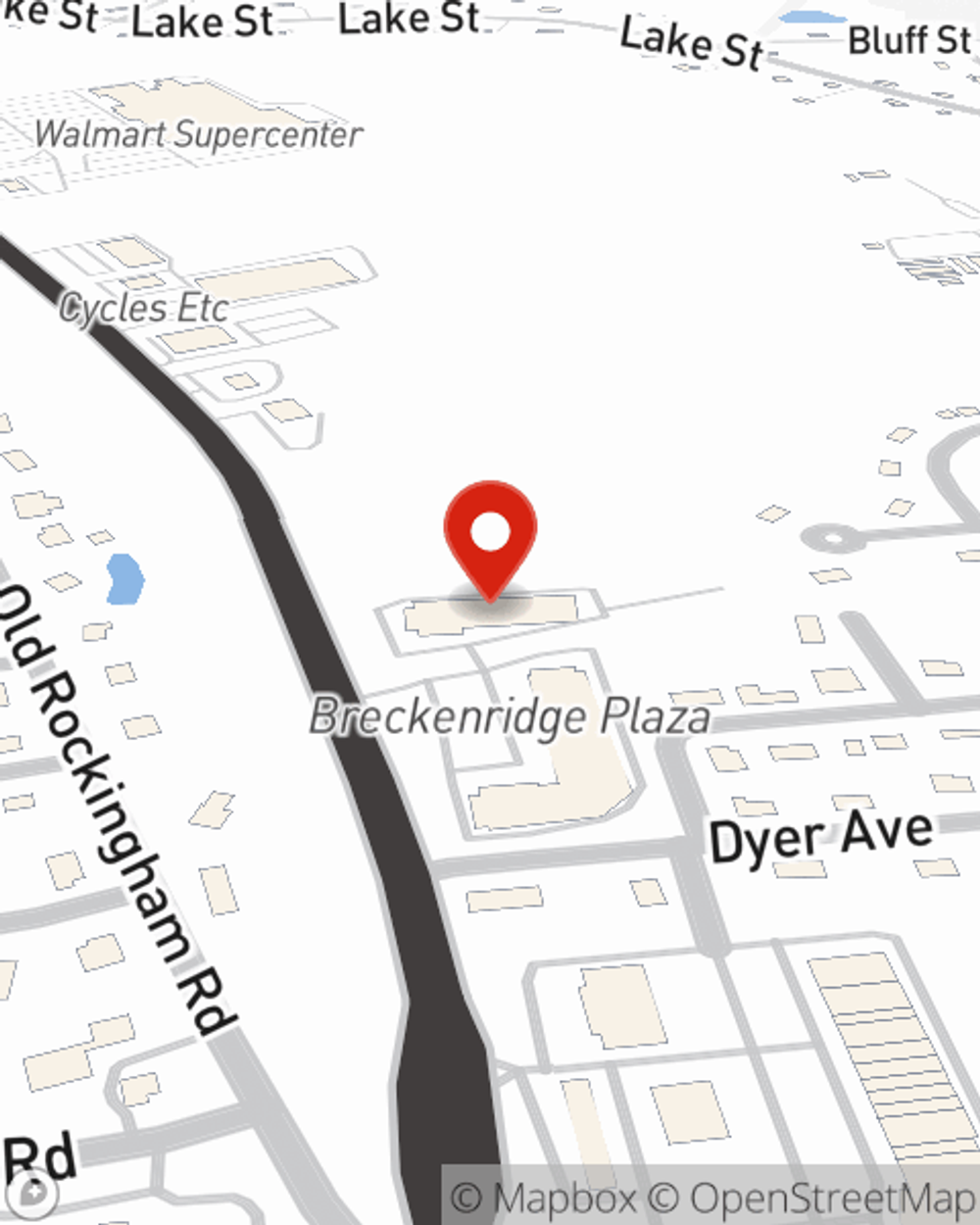

As a commited provider of condo unitowners insurance in Salem, NH, State Farm strives to keep your home protected. Call State Farm agent Ed Ibanez today and see how you can save.

Have More Questions About Condo Unitowners Insurance?

Call Ed at (603) 212-7034 or visit our FAQ page.

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.