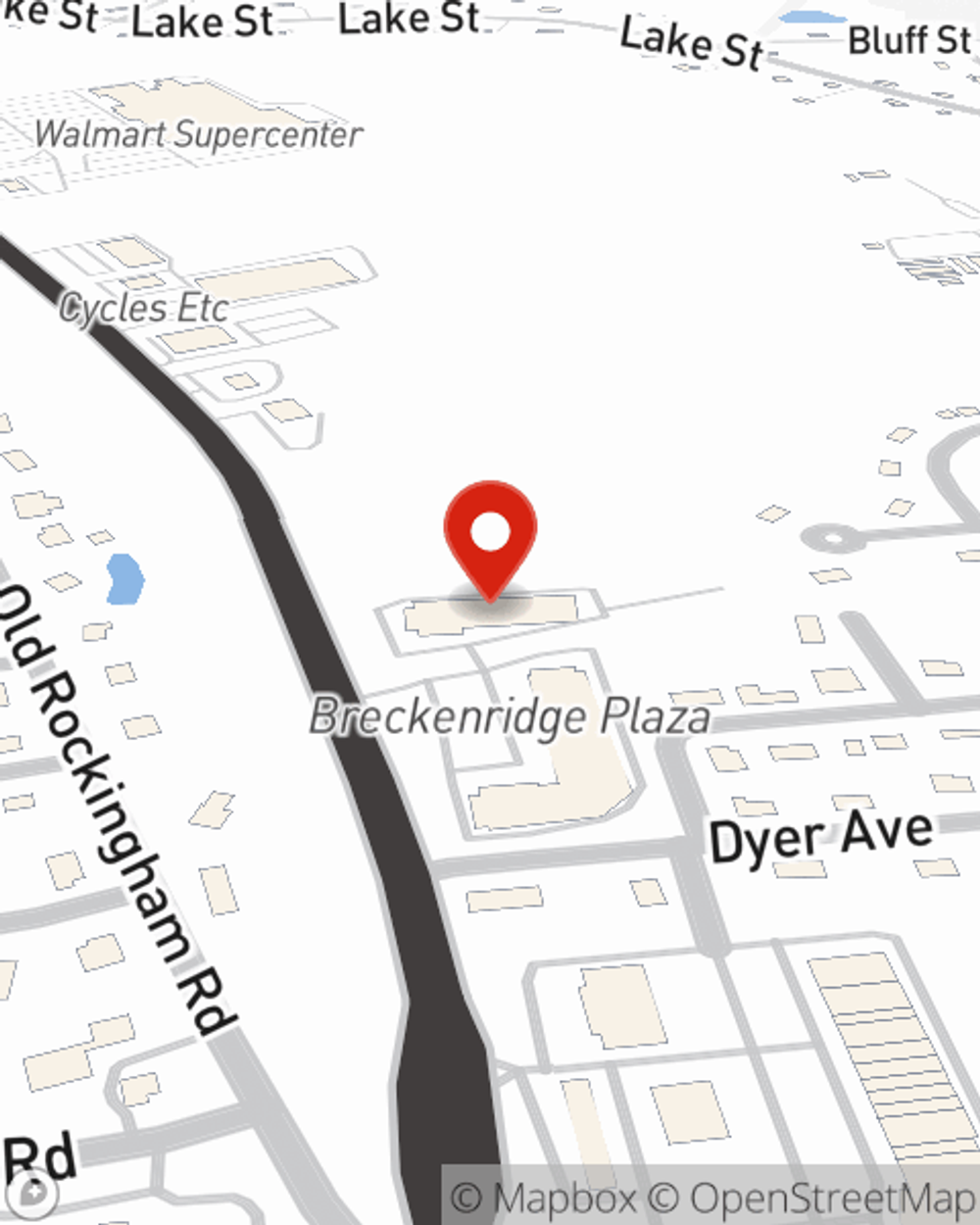

Business Insurance in and around Salem

One of Salem’s top choices for small business insurance.

Insure your business, intentionally

- Windham

- Derry

- Hampstead

- Londonderry

- Hudson

- Atkinson

- Plaistow

- Auburn

- Pelham

- Salem

- Rockingham County

- Hillsborough County

- Chester

Your Search For Great Small Business Insurance Ends Now.

Whether you own a a flower shop, a pet groomer, or a fabric store, State Farm has small business insurance that can help. That way, amid all the different options and decisions, you can focus on your next steps.

One of Salem’s top choices for small business insurance.

Insure your business, intentionally

Customizable Coverage For Your Business

Your business thrives off your creativity commitment, and having great coverage with State Farm. While you put in the work and support your customers, let State Farm do their part in supporting you with commercial auto policies, commercial liability umbrella policies and business owners policies.

As a small business owner as well, agent Ed Ibanez understands that there is a lot on your plate. Visit Ed Ibanez today to review your options.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Ed Ibanez

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.